Portfolio Partner Profile

responsAbility Access to Clean Power Fund

responsAbility’s Access to Clean Power Fund is a private debt fund that seeks to address the lack of access to clean power globally, with a strong focus on Sub-Saharan Africa and South and Southeast Asia. The Fund targets companies that provide solutions to households without access to electricity and to businesses looking for cleaner, cheaper and more reliable energy. Beyond the financing of the dynamic off-grid energy sector, the Fund will also actively address the solar potential for the commercial and industrial (C&I) sector.

Over the lifetime of the Fund, portfolio companies are expected to provide clean power to more than 150 m people, add 2,000 MW of clean energy generation capacity and reduce CO2 emissions by 6 m tons.

About responsAbility Investments AG

responsAbility Investments AG is a leading impact asset manager specializing in private market investments across three investment themes. These themes directly contribute to the United Nations Sustainable Development Goals (SDGs): Financial Inclusion, to finance the growth of Micro & SMEs; Climate Finance, to contribute to a net zero pathway; and Sustainable Food, to sustainably feed an ever-growing population. responsAbility also offers tailor-made and fund investment solutions to institutional investors. All responsAbility investment solutions target specific measurable impact alongside market returns.

Since its inception in 2003, responsAbility has deployed over USD 16.8 billion in impact investments. With over 280 employees collaborating across 6 offices, as of 30 June 2025 the company manages USD 5.5 billion in assets across approximately 300 portfolio companies in around 70 countries. Since 2022, responsAbility has been part of M&G plc, the international savings, and investments business, and contributes to enhancing M&G’s capabilities in impact investing.

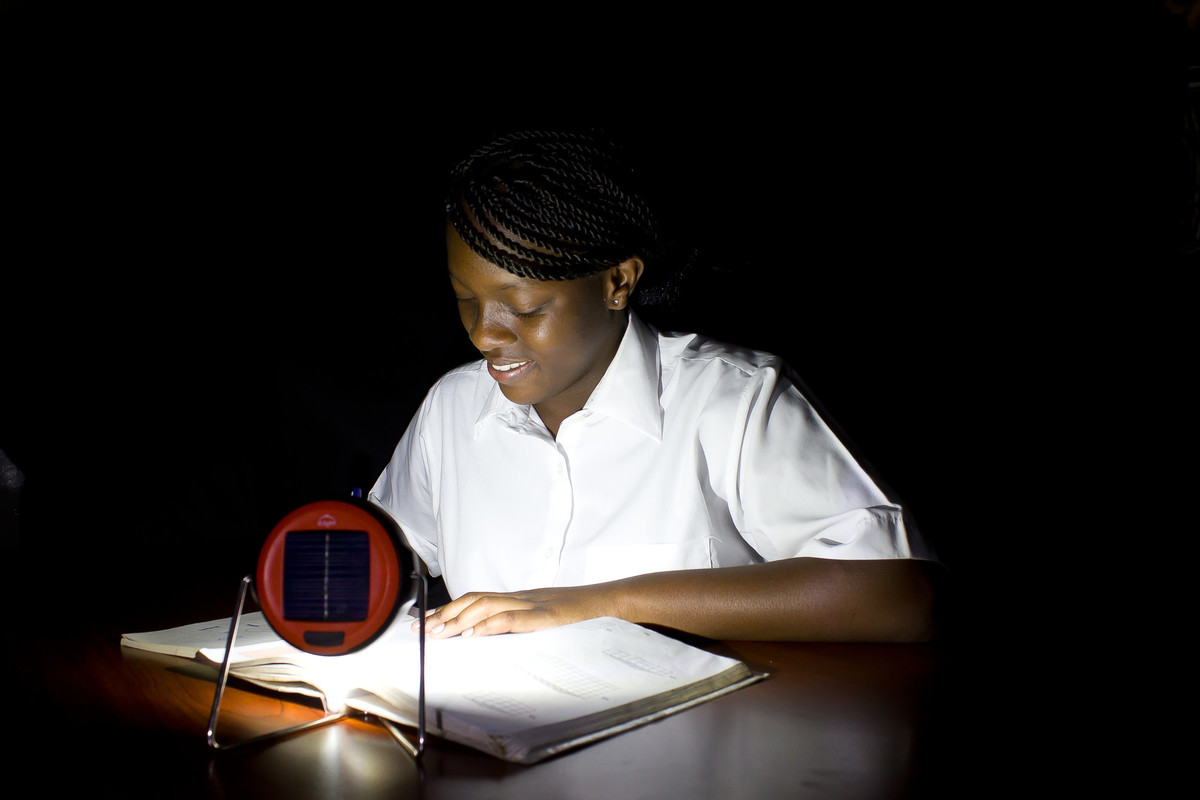

Featured Impact Story

Impact Story

candi solar

In March of 2022, the responsAbility Access to Clean Power Fund partnered with BIO, a Belgian investment company for developing countries, to provide a $10 million equivalent multi-currency loan to candi solar, a financial and clean energy platform. Candi aims to help organizations in emerging markets build and scale energy infrastructure projects across Asia and Africa. The loan will finance new solar projects in South Africa and India to mitigate the effects of climate change and will provide candi with the flexibility to allocate the funds according to the needs of their growing portfolio.

In 2024, Candi Solar secured an additional USD 18 million in debt funding from responsAbility and BIO, further strengthening its ability to scale its impact and bring solar energy to more businesses across its core markets.

In addition, Candi Solar shows a strong commitment to strengthen gender inclusion in its commercial and industrial (C&I) solar operations across India and South Africa, Candi Solar undertook a targeted, two-year, two-phased technical assistance project. With support from the Fund’s Technical Assistance (TA) Facility and implementation partner Sagana, the company aimed to improve female representation across its workforce and enhance the overall employee experience and measurably improved the participation from women in engineering and leadership roles within the company from 2022 to 2024.

Read more about this impact story here.