Borrower Spotlight: eco.business Fund and sustainable shrimp farming in Ecuador

September 07, 2021

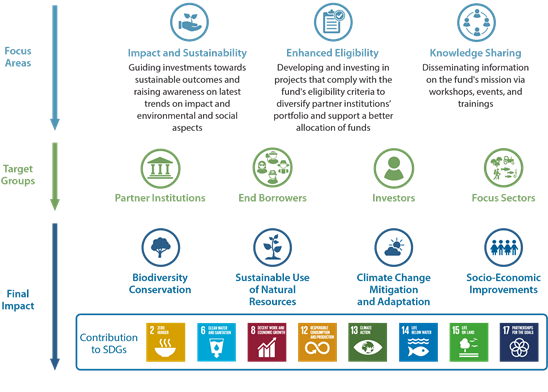

Our borrower, the eco.business Fund, is a fund focused on promoting business and consumption practices that contribute to biodiversity conservation, the sustainable use of natural resources, and climate change mitigation and adaptation. The fund concentrates on the following four types of sustainable activities: Agriculture and agri-processing, fishery and aquaculture, forestry, and tourism. Its current geographical scope is Latin America, the Caribbean, and sub-Saharan Africa.

In recent years, Ecuador has become one of the world's most dominant shrimp producers. Between 2010-2020, the Ecuadorian shrimp sector has grown fivefold to $3.6 billion, and today Ecuador is the world's second-leading exporter of shrimp. As Ecuador's shrimp sector grows, so does the importance of sustainable shrimp farming practices – not only to Ecuador's economy, but to its environment and ecosystem. Unsustainable shrimp farming practices can lead to deforestation or pollution of mangrove trees, which are critical to preventing coastal erosion, maintaining water quality, storing carbon to mitigate climate change, and providing habitats for thousands of species. Mangroves are one of the most important defenses in absorbing surge impacts during increasingly common extreme weather events. Unsustainable shrimp production can also lead to water pollution through the spread of chemicals like diesel, pesticides, and antibiotic use.

Our borrower, the eco.business Fund, is leading the way in helping Ecuadorian shrimp producers implement practices that protect the environment and pave the way for long-term, sustainable economic growth and mitigation of climate change. As one example, in January 2021 the eco.business Fund provided a $15 million loan to Pesquera Santa Priscila, Ecuador's largest shrimp producer, to further bolster the company's sustainable shrimp practices. Already certified as meeting requirements for Global Aquaculture Alliance/Best Aquaculture Practices – a third-party verification ensuring food is produced through environmentally and socially responsible means – the loan allowed the company to make even deeper commitments to sustainability and reducing their environmental footprint.

Specifically, the loan enabled the company to migrate to electricity and away from a diesel-run production infrastructure, as well as to acquire electric equipment such as automatic feeders and aerators to improve production. With these changes, the company improved the survival rate of their shrimp by 10%, reduced the feed conversion ratio by 17% (meaning shrimp are farmed more efficiently), and reduced nitrogen and phosphorus loads in the water – a major contributor to water pollution that often lead to an overgrowth of algae that harms ecosystems. Additionally, Pesquera Santa Priscila now has 1,438 hectares (about 3,500 acres) of mangroves under protection. The fund also has been collaborating with the company to strengthen their Environmental and Social Management System and improve their ability to systematically assess and mitigate environmental and social risks.

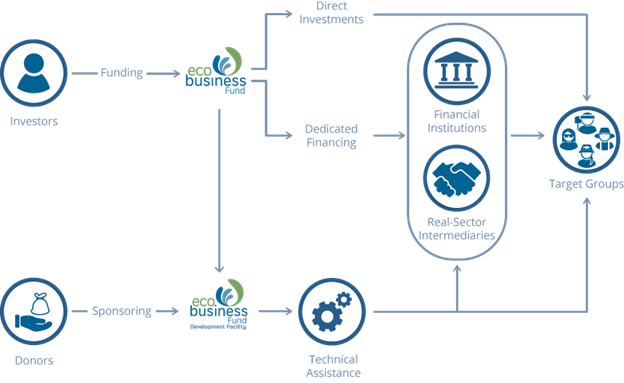

The eco.business Fund and the Development Facility work in tandem to provide both financing and technical assistance to improve sustainable farming practices.

Source: https://www.ecobusiness.fund/en/the-fund

Another example of the eco.business Fund’s success in promoting a sustainable shrimp industry is its work through its Development Facility for Latin America and the Caribbean, which provides technical assistance to the fund’s borrowers to help them adopt sustainable business practices. In summer 2021, the fund announced the results of its Development Facility work with two other Ecuadorian shrimp producers to enhance their production and processing practices, with the goal of helping the companies close gaps to obtain the Aquaculture Stewardship Council (ASC) certification. ASC certification is the world’s leading certification process for farmed seafood.

Specifically, the Development Facility helped the companies install automatic feeders and create more efficient ventilation to improve shrimp survival rate, reduce harvest time, increase productivity, and reduce energy use. The Development Facility also helped the companies conduct environmental and biodiversity impact studies to identify impact risks at the ecosystem level and to help farmers demonstrate compliance with the biodiversity and ecosystem components of the ASC certification.

The eco.business Fund's impact framework

Source: https://www.ecobusiness.fund/en/the-development-facilities

The Development Facility also helped the companies make progress toward ASC certification criteria including purchasing shrimp feed with sustainable ingredients, restricting the use of antibiotics, conducting environmental and social impact studies, and ensuring safe and equitable working environments where employees earn a decent wage and have regulated working hours.

This work with shrimp producers in Ecuador is just one example of the eco.business Fund’s global efforts to build a more sustainable world. Learn more about their work in the video below.

About eco.business Fund: The eco.business Fund aims to promote business and consumption practices that contribute to biodiversity conservation, to the sustainable use of natural resources, and to mitigate climate change and adapt to its impacts in Latin America, the Caribbean, and sub-Saharan Africa. By providing financing for business practices that conserve nature and foster biodiversity, the fund seeks investments with both environmental and financial returns. The eco.business Fund provides financing through three avenues: local financial institutions that are committed to the fund’s mission and which have the capacity to reach its target group; directly to its target group (i.e. companies and producers); and in the case of sub-Saharan Africa, to real sector intermediaries. The fund supports sustainable operations in the sectors of agriculture, fishery (including aquaculture), forestry and tourism. Target beneficiaries are those that hold an eligible sustainability certification or those taking out a loan to make eligible sustainable investments in their operations.

An impact investment fund advised by Finance in Motion, the eco.business Fund was initiated by Germany’s KfW Development Bank and Conservation International with financial support from the German Federal Ministry for Economic Cooperation and Development (BMZ). The sub-fund for Latin America and the Caribbean has received further support from the European Commission. The sub-fund’s additional investor base comprises IDB Invest, a member of the Inter-American Development Bank (IDB) Group, the U.K. government’s Department for Environment, Food and Rural Affairs, Dutch development bank FMO, Austrian development bank OeEB, and institutional investors such as sustainable banking institution ASN Bank, German ethical bank GLS Bank, Calvert Impact Capital, and Raiffeisen Bank International. Finance in Motion, a leading impact investing company, is also an investor.

Operating together with each of the two sub-funds, are two development facilities that provide high-impact technical assistance to investment partners and final borrowers.

Learn more about CRF and our other borrowers in our Portfolio List.