Borrower Spotlight: PACE Equity funds greener commercial buildings in the US

April 11, 2022

Our borrower, PACE Equity, is the market leader in Commercial Property Assessed Clean Energy (“C-PACE”) financing. C-PACE programs provide inexpensive private capital for efficiency improvements to commercial properties. Since its inception in 2014, PACE Equity has been a force of innovation in the market. PACE Equity was the first firm to use C-PACE financing for new construction and for projects with complex capital stacks, such as those involving historic tax credits.Most recently, PACE Equity developed a C-PACE financing option with pricing incentives for buildings owners who achieve very low levels of carbon emissions.

With all the focus on single-family homes—and the SUVs in their garages—commercial buildings are an often-overlooked contributor to global warming. But in the U.S., buildings account for more than two-thirds of electricity consumption and 40% of carbon dioxide emissions.

Unless we take action, carbon emissions from commercial real estate will keep growing. In 2013, the median age of a U.S. commercial building was 32 years, and given current construction trends, much of the existing U.S. building stock will be 70 years old by 2050. When it comes to buildings, old means inefficient. According to the EPA, 30% of the energy used in commercial buildings is wasted.

To begin whittling down that number, 30 U.S. states have passed C-PACE enabling legislation. In turn, dozens of counties and municipalities within those states have created programs where building owners can apply for C-PACE financing for building improvements that achieve meaningful reductions in energy, water, and carbon intensity. These funds are repaid through a long-term tax assessment on the property that is senior to most other liabilities and transferable at sale. The result is a highly secure asset for lenders and an extremely low-cost and long-term source of funds for efficiency improvements like upgraded HVAC systems; energy efficient windows, lighting, and roofing; and solar panels.

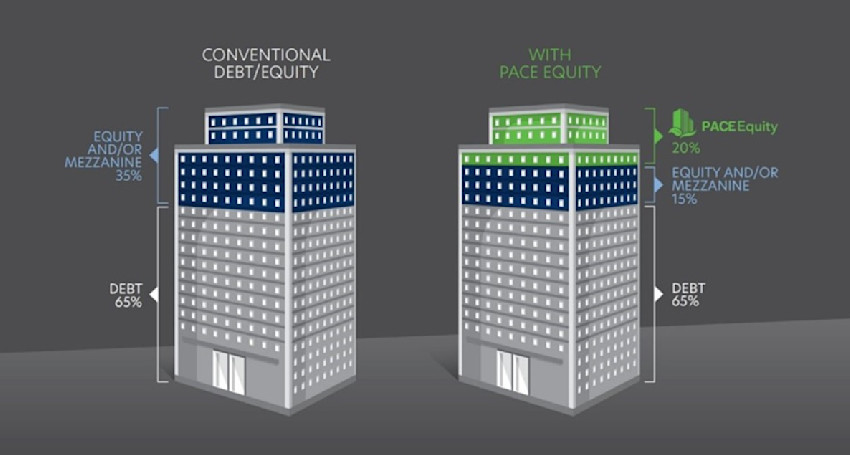

With boots on the ground in almost every market that has C-PACE programs, PACE Equity teams up with commercial real estate owners and developers to perform required energy engineering reviews for their projects, help them navigate local C-PACE regulations and finally, provide C-PACE capital. C-PACE financing represents a critical piece of the “capital stack” —along with mortgage borrowing and scarce equity and mezzanine capital—that enables a project to go forward.

A good example of PACE Equity’s projects is the repurposing of two former NASA buildings near Cleveland, Ohio. One building is being renovated into apartments and the second building is being renovated into a select-service hotel. PACE Equity is providing $10.4 million to finance upgrades to the building’s building envelope, plumbing, insulation and thermal moisture protection.

Many of PACE Equity clients are pivoting to take advantage of PACE Equity’s latest innovation, the CIRRUS™ Low Carbon program. With CIRRUS, developers work with PACE Equity engineers to conform their projects to a higher efficiency standard created by the New Buildings Institute. In doing so, they can achieve a cost of capital that’s even lower than what they would get through a conventional C-PACE financing.

The new CIRRUS designation is comparably stringent to the well-known LEED certification. For example, CIRRUS buildings must, at the minimum, achieve an 8% reduction in carbon emissions relative to the efficiency standard required for LEED certification. But one benefit of CIRRUS is that it is conferred before the project is completed and can therefore be leveraged in the project’s marketing program to attract anchor tenants who want to move into a new—or newly refurbished—green building. This removes significant barriers that might otherwise prevent owners from making their buildings more efficient.

We're proud to partner with PACE Equity in charting a practical and actionable course to a low carbon future.