Calvert Impact Capital 2021 Business Update

February 04, 2021

Download the 2021 Business Update PDF.

Dear friends –

When we shared our three-year strategy last year, I wrote that “to say that we are living in extraordinary times would be an understatement.” This year, we continue to grapple with major systemic issues -- climate change, historic levels of income and wealth disparity, economic uncertainty due to a global pandemic, structural racism and discrimination – and while these challenges remain, I write with cautious optimism for the year ahead.

The pandemic has exacerbated the flaws in our systems, but it has also spotlighted them, creating widespread awareness and demand for solutions. Our 2020 investor survey found that 44% of all investors – and 72% of millennial investors – are more likely to invest for impact since the COVID-19 pandemic began. Investors’ top two areas of interest are Environmental Sustainability and Racial Equity.

Investors are moving their money into sustainable options at record rates, and the common refrains that many of us in the impact investing field have repeated for decades are being elevated: where you invest your money matters, how you invest your money matters, your investment portfolio can do more than earn you returns – it can finance a better world.

Last year, as the pandemic unfolded, our strategy remained unchanged, but our execution shifted. We focused on supporting our borrowers while remaining good stewards of our investors capital and helped leverage existing infrastructure to quickly move capital into communities in need through small business relief funds in New York and California.

We remain focused on those critical issues this year and are looking to transition near term needs into long term solutions to the enduring challenges that we were created to address.

Our 2020-2022 strategy was formed in 2019 with the recognition that we need bold, urgent action in response to our shared global challenges. As we begin a new year, the need is stronger than ever. There is an opportunity for big, powerful change that we cannot, and will not, waste. 2021 will find Calvert Impact Capital focused on creating new products and services that move capital where it is needed at scale, exploring new sectors and structures, expanding our impact management and measurement expertise, and continuing to share our learnings along the way.

2020 in review

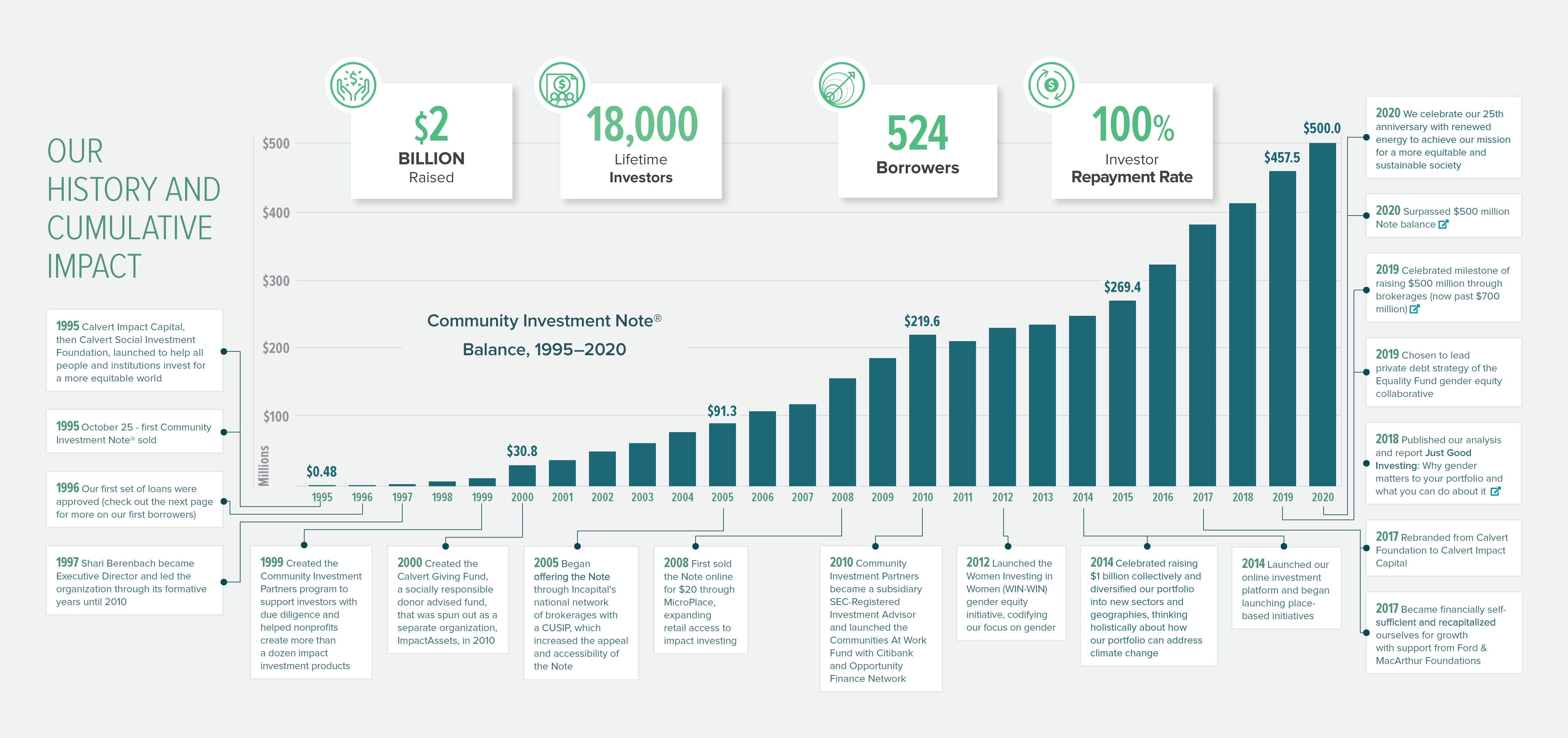

Throughout 2020, our team acted with urgency and deep consideration for our borrowers and investors and continued to do what we do best: connect capital with communities. In October, we marked our 25th anniversary. Over the past two-plus decades our 18,000+ investors have enabled us to make more than 1,000 loans and investments to over 500 organizations across 100+ countries, supporting hundreds of thousands of businesses and benefitting millions of lives around the world. The clarity of our vision, the strength of our mission, and the experience and knowledge we have built up over the past 25 years anchor our work and point us towards the future. Read More.

Key accomplishments

Covid Relief Funds

Small businesses across the country face enormous challenges in the face of the pandemic and many were left behind by government relief programs like the Paycheck Protection Program (PPP). As our VP of Strategy & Syndications Beth Bafford wrote “When COVID hit our economy in March and tens of millions of small businesses across the country were affected, we got a rare, system-wide glimpse of the challenges with our banking system. If you picture our banking system as an electric grid – set up to connect flows from the sources of money to the bank accounts of individual businesses – we learned quickly that a massive share of our economy was in the dark.”

That is why we – in partnership with state and local governments, banks, corporations, foundations, local community organizations, and Community Development Financial Institutions (CDFIs) – created the concept of the Community Recovery Vehicle, a model that is currently active across the states of New York and California that we are actively replicating in other parts of the country.

Leveraging the power and expertise of CDFIs, Community Recovery Vehicles provide affordable, flexible capital and technical assistance to businesses with less than 50 employees as they navigate the pandemic, with a particular focus on reaching low-income communities and businesses owned by women and people of color who have been historically unbanked.

In 2021, we’ll continue to expand these funds with interested partners across the country and explore methods to further strengthen and support the CDFI industry.

Record Note Sales

Our Community Investment Note® balance grew over 17% and exceeded $500 million for the first time in 2020 as we expanded our work during this year of unprecedented social, environmental, and economic challenges. As Justin Conway, VP of Investment Partnerships noted “our investors are passionate, and we found an increasing number of new investors looking to invest for racial and climate justice.”

This represented a significant sales milestone for Calvert Impact Capital and served as yet another indicator of the increasing popularity of investing for positive social and environmental impact alongside financial returns.

Strong Deployment

With growing investor interest and strong portfolio partners, Calvert Impact Capital deployed capital throughout 2020 in prudent, high-impact ways. “At a time when other lenders were pulling back, Calvert Impact Capital’s support enabled us to stay in the market and strive to meet the need for quality affordable housing, which is more acute than ever,” said Randy Parker, Managing Director and Chief Financial Officer of Preservation of Affordable Housing, Inc. (POAH). New deployment totaled $130 million in 2020 and supported long-time partners with acute capital needs and new financial structures addressing climate solutions.

Looking Ahead: 2021

Looking ahead in 2021, we see several major trends: continued expansion of the sustainable and impact investing market; increased demand for climate action; growing investor interest in accountability; renewed policy agenda for impact; and demand for an economy that works for all, addressing systemic racism and discrimination:

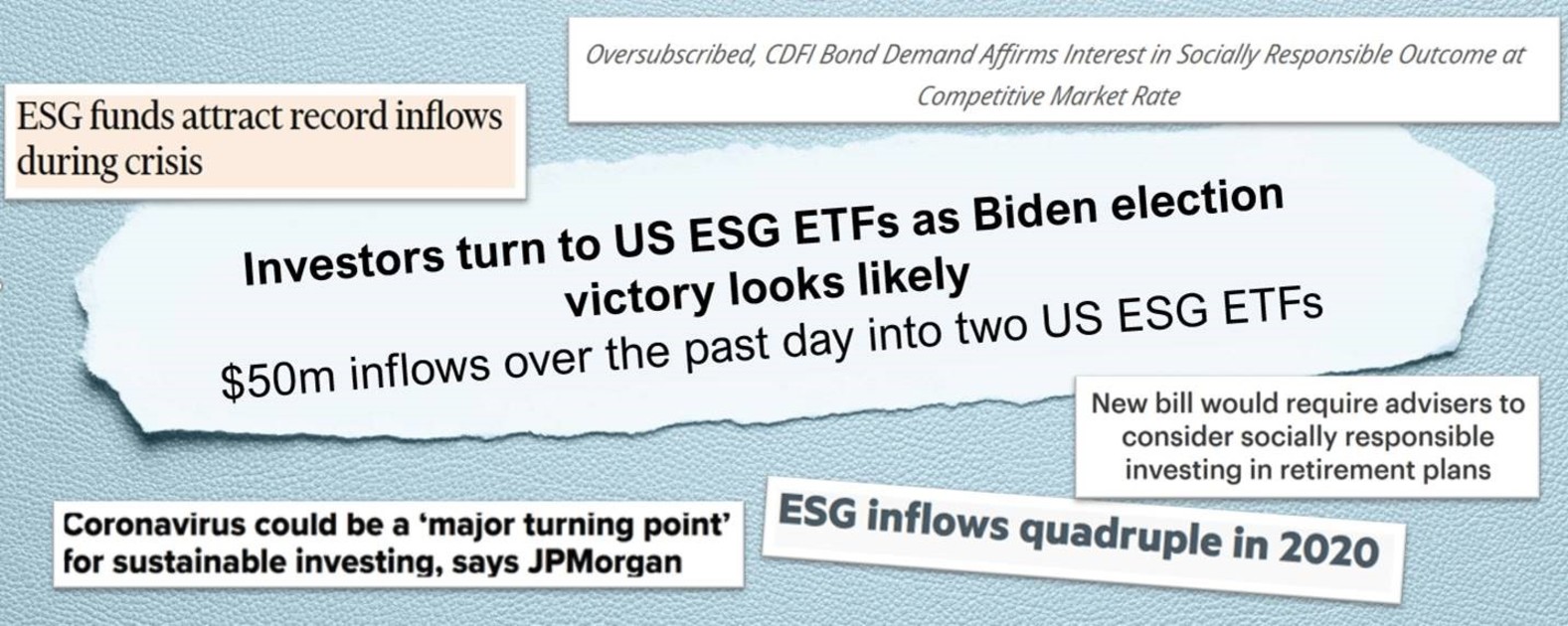

Sustainable and impact investing gain widespread market adoption

These were just a few of the headlines we saw in 2020 about the record growth of sustainable (ESG, SRI, impact) investing. While this trend has been building for years, it accelerated as the pandemic highlighted the importance of paying attention to systemic risk and investors looked for companies that were prepared for the long-term and ESG funds proved resilient. The COVID pandemic has also been characterized as a “sustainability crisis”, one that has served as a wakeup call to investors that business as usual will not be a successful strategy for the future. As Fiona Reynolds CEO, Principles for Responsible Investment (UNPRI) wrote, “The pandemic has served as the first real proof-point for sustainability, underlining the fact that ESG investing doesn’t come at a cost, but more than that can future-proof investments and in some cases boost returns, all while helping to shape a better future. In the face of this crisis, the facts are now proving the resilience of sustainable investing.” In addition to considering ESG factors at large corporations, we see more interest in impact investing in the community-based solutions Calvert Impact Capital supports.

Increased climate action

Many have framed the COVID pandemic as a harbinger of what’s to come from an even more deadly and complex global challenge: climate change. As Bill Gates wrote, “To understand the kind of damage that climate change will inflict, look at COVID-19 and spread the pain out over a much longer period.” As our survey data continues to show, investors are eager for solutions. With COVID as a focusing mechanism, renewed political will, available capital, improved technology and widespread recognition that addressing climate change is a path to economic growth and the key to our survival, there will be a lot of climate action in the impact investing field.

Growing interest in accountability and transparency

Impact management and measurement has grown in leaps and bounds, particularly over the past two years with the launch of the Operating Principles for Impact Management, of which Calvert Impact Capital is a founding signatory. As interest in sustainable investing grows, so will demands for genuine accountability and transparency, particularly in light of pledges that corporations and investors have made related to racial justice and equity. Continued consolidation of standards and metrics will help the industry scale and efforts to formalize how companies can measure and report on sustainability performance in the accounting community will be important to watch.

Renewed policy agenda for impact

There is renewed interest and energy in activating policy levers to “transform community investing to confront inequality,” and to “advance stakeholder capitalism to restore American economic leadership.” As the pandemic has demonstrated, strong public sector partners around the world are critical to ensuring that we can recover from the COVID crises and chart a strong course for the future.

Demand for an economy that works for all

Addressing extreme wealth and income inequality is an urgent task. The pandemic has highlighted and exacerbated existing gaps, particularly in communities of color. The racial wealth gap has grown substantially over the past 35 years and we see that reflected in the suffering from COVID today. Impact investors will remain focused on creating opportunities for people and communities that have long been denied them, deliberately incorporating a focus on racial justice and equity into investment strategies – and investors will be holding them accountable.

Our 2021 Strategy

Four principles set the stage for our new strategy:

Market Leadership

We will work to expand our product offerings that are attractive to investors and authentically serve communities. Specifically, we are exploring new offerings that will support climate solutions, racial equity, and access to opportunity where we see both massive market opportunity and strong investor demand. Our focus will be on developing products and services that challenge the way capital is allocated while working through existing financial infrastructure to create meaningful scale.

Market Creation

We will continue to expand the Community Recovery Vehicles, working with public, private, and philanthropic partners in regions across the country to develop funds similar to New York Forward Loan Fund and California Rebuilding Fund. These efforts aim to build capacity and strengthen the infrastructure for CDFIs now and in the future so they can play a larger role in increasing access to affordable financial products and services in unbanked communities across the country. Efforts are underway to replicate this model across the South and in Washington State.

No Margin, No Mission

Calvert Impact Capital is committed to finding high quality, high impact deals in communities that aren't served by traditional capital markets, that generate both financial resiliency and sustainable impact.

We bring this perspective to our portfolio and to our organization as a whole. We focus on achieving self-sufficiency as a guiding principle for our work and view this as key to our continued success and expansion as an organization.

Transparency and Collaboration

We are dedicated to collaboration to advance our greater mission, working with partners across sectors, countries and domain expertise to offer solutions together that are greater than the sum of their parts.

Calvert Impact Capital remains committed to analyzing and sharing our experience as a practitioner to help advance and expand the impact investing field. This year we will focus on disseminating content on faith-based investing, impact management and measurement, gender equity and more.

We look forward to working together to accomplish these goals and more in 2021. If you’re interested in learning more or joining us in this work, please email partner@calvertimpactcapital.org.

Jennifer Pryce President & CEO