Dear Impact Investors: Consider Affordable Housing

April 24, 2018

Affordable housing was my introduction to impact investing. About 25 years ago I was a new program associate at a grant-making foundation that provided capital grants to affordable housing developers in Northern California, and we regularly had opportunities to tour our grantees’ developments in and around San Francisco.

On one of these visits, with BRIDGE Housing, we met with a small group of residents who shared their stories of how safe and affordable housing had improved their lives: stability in school for their children, a short commute to work, a safe place for a grandmother to care for her granddaughter. We spoke with a neighborhood store owner who told us how business had improved and crime had dropped in the years since the redevelopment project was completed.

That afternoon, Don Turner, then-President of BRIDGE Housing, explained to me how an equity investment from the California employee state pension fund, debt financing from a commercial bank, and a portion of the grant we had provided them made the development possible.

A resident at a BRIDGE-renovated affordable housing center in Oakland

A resident at a BRIDGE-renovated affordable housing center in Oakland

The impact these developments had on the lives of their residents and their neighborhoods, and the complex layering of public and private financing to make them happen was a fascinating and inspiring combination.

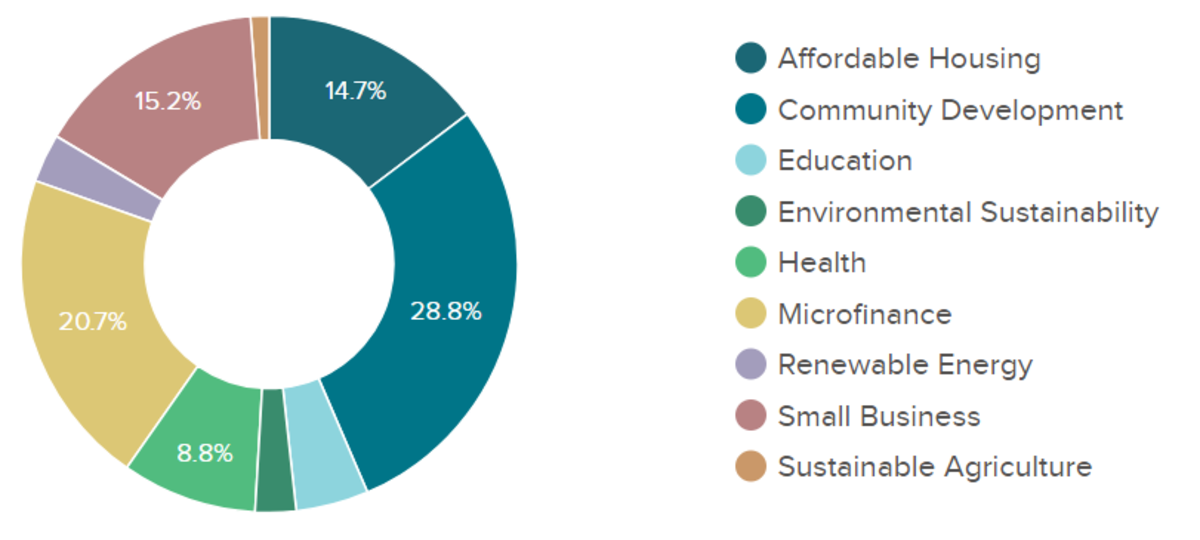

More than two decades later, I continue to create and preserve affordable housing through my work at Calvert Impact Capital, where more than $50 million of our portfolio is invested in affordable housing.

Calvert Impact Capital's portfolio breakdown by sector

Calvert Impact Capital's portfolio breakdown by sector

Just as I saw in San Francisco, the outcomes of this work go far beyond a roof over people’s heads; affordable housing contributes to improvement in health, education, and economic opportunities.

The need for affordable housing in the U.S. is growing, and with it, opportunities to invest for impact. Given the potential to generate financial returns and create impact in underserved U.S. communities, it seems that impact investors should be flocking to affordable housing ... but that doesn’t seem to be the case. Why hasn’t affordable housing been more popular among mission-driven investors?

Affordable Housing Finance: A Victim of its Own Success

The United States housing finance system is the world’s most advanced, and I suspect it is precisely that sophistication that deters newer impact investors from exploring this sector. We have well-functioning secondary markets for both homeownership and rental housing finance, and we’ve successfully developed and scaled tools for leveraging public subsidy with private capital in affordable housing through products like tax credits, bonds, and loan guaranty programs.

Beginning largely in the 1970s, the U.S. Department of Housing and Urban Development subsidies provided incentives for private owners to own and manage affordable housing. With tax reform in the mid-1980s, Congress created the Low Income Housing Tax Credit Program, which has been the primary affordable housing production tool in the past three decades. It has helped attract private (mostly) institutional capital to invest in the creation of more than three million units of housing for working families, veterans, seniors, and the disabled across the country. This is blended finance at work.

These successes have given many impact investors the impression that their capital is not needed for affordable housing. Indeed, a 2014 paper by Strength Matters states: “[impact] investors interviewed commented that the affordable housing market is seen as something taken care of by larger banks and institutions.”1

“[impact] investors interviewed commented that the affordable housing market is seen as something taken care of by larger banks and institutions.”

While it is true that many of the funding needs for affordable housing are addressed by our mature and well-developed housing finance system, the market is far from “taken care of.” The affordable housing crisis persists (and has worsened), and the sources of flexible, catalytic capital critical to getting projects off the ground are still scarce.

The housing crisis in America

We have a severe affordable housing shortage in this country. By definition, housing is “affordable” if the resident spends less than 30% of their income on housing.2

America’s affordable housing strategy can be summed up as taking one step forward, two steps back. Each year we produce about 100,000 units of affordable housing in the U.S., but we lose about 200,000 units to deterioration or conversion to more expensive housing.3

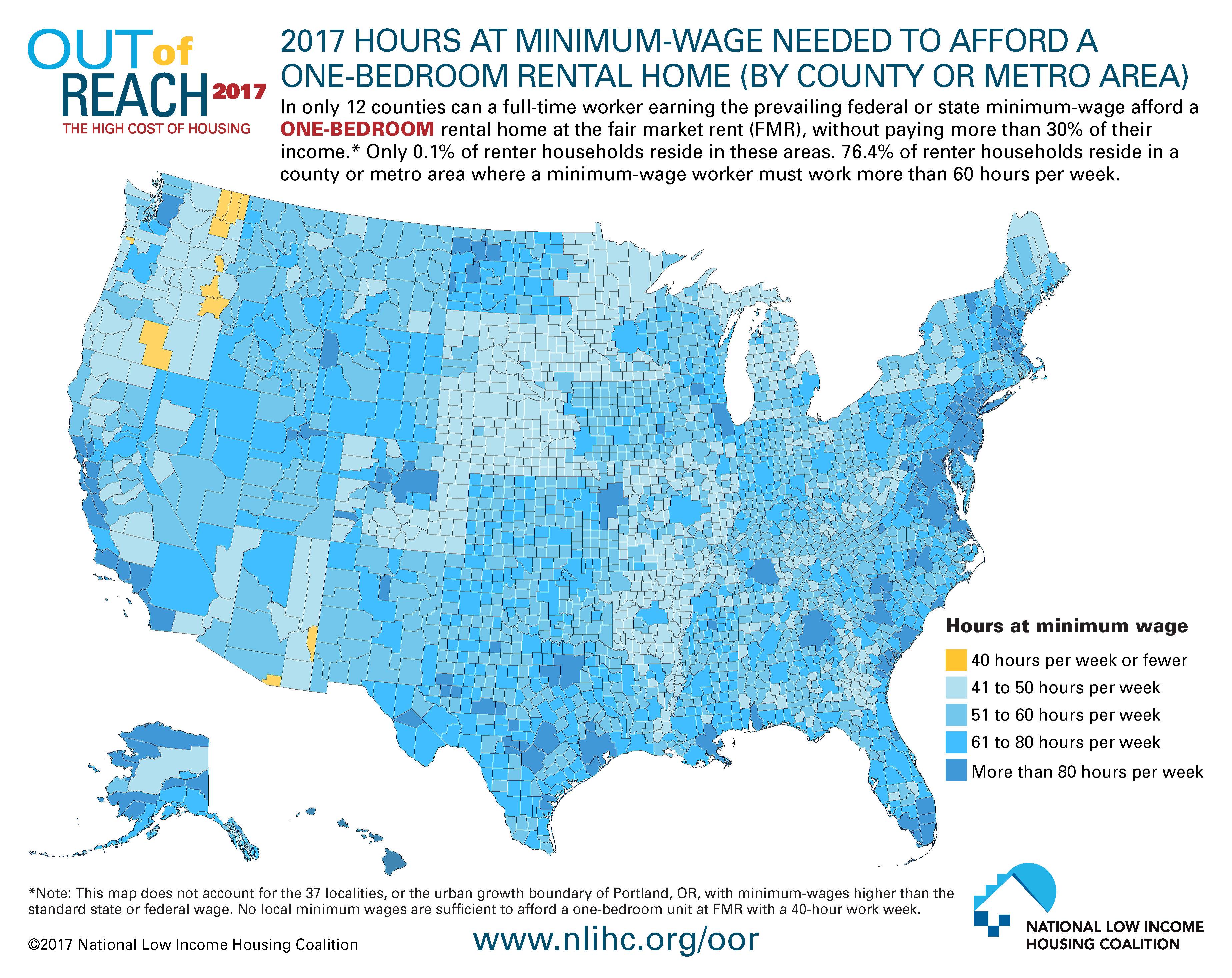

NLIHC's Out of Reach 2017:The High Cost of Housing

NLIHC's Out of Reach 2017:The High Cost of Housing

And the need for these units is very real: a full-time worker at a minimum-wage job cannot afford a modest two-bedroom rental home in any state in the U.S. In only 12 counties across the U.S. is a one-bedroom rental home affordable to someone working full time at a minimum-wage job.4 This problem goes beyond low wage workers. Nearly half (48%) of all renters in this country pay more than 30% of their income for housing. More than one in four (26%) of renters pay more than 50% of their income for housing. That’s 11.2 million households spending less on basic needs such as food, healthcare, and transportation because they are spending more on rent.5

At the same time, the affordability gap is widening. Median income for renter households rose 1% from 2007 to 2015, while median gross rent increased 6%.6

Housing insecurity undermines employment, health, education, and other key elements of a sustainable path to the middle class. The consequence of the affordability gap is costly for individuals, families, communities, and the economy. Today we have the largest disparity between homeownership rates of white households (71.9%) and black households (42.2%) that we’ve seen since World War II.7 The impact of safe, affordable housing cannot be overstated.

Affordable homeownership is a powerful way to shrink the wealth gap in this country, reduce intergenerational poverty, and increase long-term financial stability.

The role of our capital: catalyzing critical pre-development work

Affordable housing developers and housing-focused lending intermediaries have grown and scaled their work in large part thanks to effective public financing tools and the institutional capital that invests in the sector. But a critical part of their work lies in filling in the gaps, providing capital for predevelopment-stage activities, and offering flexible financing products that traditional sources of capital can’t or won’t provide.

A critical part of their work lies in filling in the gaps, providing capital for predevelopment stage activities, and offering flexible financing products that traditional sources of capital can’t or won’t provide.{.green}

Developers incur expenses to renovate or develop new or existing affordable housing projects before the long-term, secured capital sources are in place. This includes funds for property acquisition, site planning, architects, etc.--money that needs to be spent to make the project happen but can’t wait for the full capital stack (with equity, debt, tax credits, grants) to come together. The funding for these predevelopment activities is often the most difficult to secure, despite the fact that it is the truly catalytic piece of the puzzle that is leveraged many times over.

At Calvert Impact Capital, this is where we focus our affordable housing investments. We lend, on an unsecured basis, to the balance sheets of housing developers and lenders. With this flexible, responsive capital, they can compete with market-rate developers and fill in the financing gaps that arise before they secure long-term, secured capital solutions. Ultimately it means they can meet their communities’ housing needs more effectively.

Central City Concern’s Blackburn Building and the Eastside Health & Recovery Center

Central City Concern’s Blackburn Building and the Eastside Health & Recovery Center

Calvert Impact Capital’s very first loan was to Central City Concern, a developer of affordable housing for the homeless in Portland, OR. Central City Concern is still a borrower in our portfolio and we continue to support their expansion in housing, enabling them to serve a larger percentage of the homeless population in their city.

At the end of 2017, 15 percent of our loan portfolio, more than $50 million, was deployed to 25 developers and lenders working to create affordable housing solutions across the US. These organizations reach diverse communities across the U.S.: urban and rural areas, veterans, artists, and the aging, and even those in areas affected by natural disasters.

We work with incredible partners who put our money to work to help the most vulnerable populations across the country, while remaining strong financial stewards of the capital they borrow. We hope that our history and experience lending flexible and catalytic capital--and the potential for outsized impact--can inspire others to do the same. Housing is a critical part of our success as a nation and we’re going to need all hands on deck.

When you think about where to invest for impact, don’t overlook affordable housing.

2 https://www.hud.gov/program_offices/comm_planning/affordablehousing

3 NHT-Enterprise Corp

4 NLIHC's Out of Reach report.

5 Source: Joint Center for Housing Studies, State of the Nation's Housing 2017

6 NLIHC: Out of Reach 2017

7 JCHS SONH