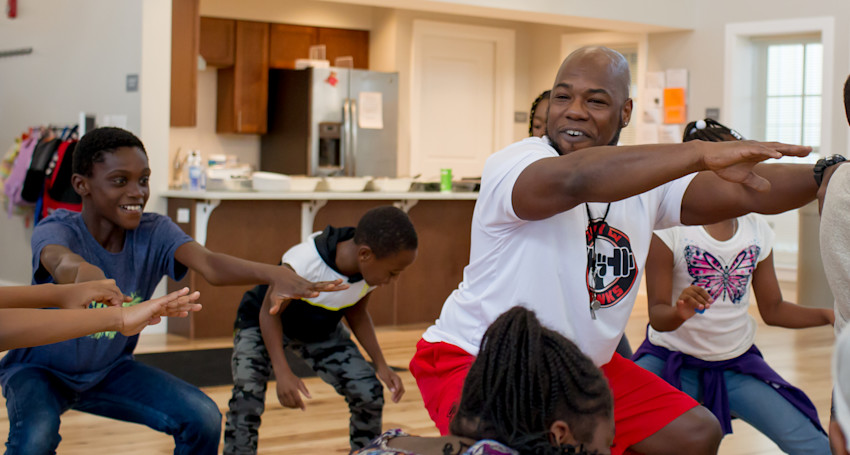

Photo courtesy of Jonathan Rose Companies

New Rates To Meet the Needs In Communities

April 01, 2021

We are finally beginning to see some light at the end of the COVID-19 pandemic tunnel as it relates to vaccine roll-out, the broader economy, and the hope of being able to convene with people outside our immediate household. That said, unfortunately the light is not as close for many people of color, women, and low-income communities who continue to face inequitable challenges in accessing housing, healthcare, jobs, childcare, and other critical services. In many cases, the pandemic has further exacerbated the inequities and pushed the light further away.

Fortunately, we have portfolio partners well-positioned to help their communities make it through these challenging times. While portfolio quality and demand remain high, we are lowering the rates on our Community Investment Note® today to meet the needs for lower cost capital.

| Old Rates | News Rates as of April 1, 2021 | |

|---|---|---|

| 1 year | 0.50% | 0.40% |

| 3 year | 1.50% | 1.00% |

| 5 year | 2.50% | 1.50% |

| 10 year | 3.00% | 2.50% |

| 15 year | 3.50% | No longer offered |

This does not change the rates of any existing Notes, only new Notes opened on or after April 1st, 2021. While we’re not seeing investor interest to continue offering a 15-year term, we appreciate those that have provided this longer-term financing to us.

Our rates are determined by the financing needs of our portfolio partners and not the broader market forces that make headlines. Our investors know that we have not changed rates often – increasing rates a single time in 2016 and in 2018, and then lowering once in 2020 and again today. We always base our rates on the portfolio pricing demand we see going forward in the impact sectors and communities we serve.

Overall, we strive for consistency with the Community Investment Note® – a product that has paid investors returns on over $2 billion invested, while consistently creating measurable impact for 25 years. We are even more resolved today to continue meeting the evolving financing needs in communities with the support of caring impact investors.